Cash Pay vs Insurance: Find the Right Model for Your Practice

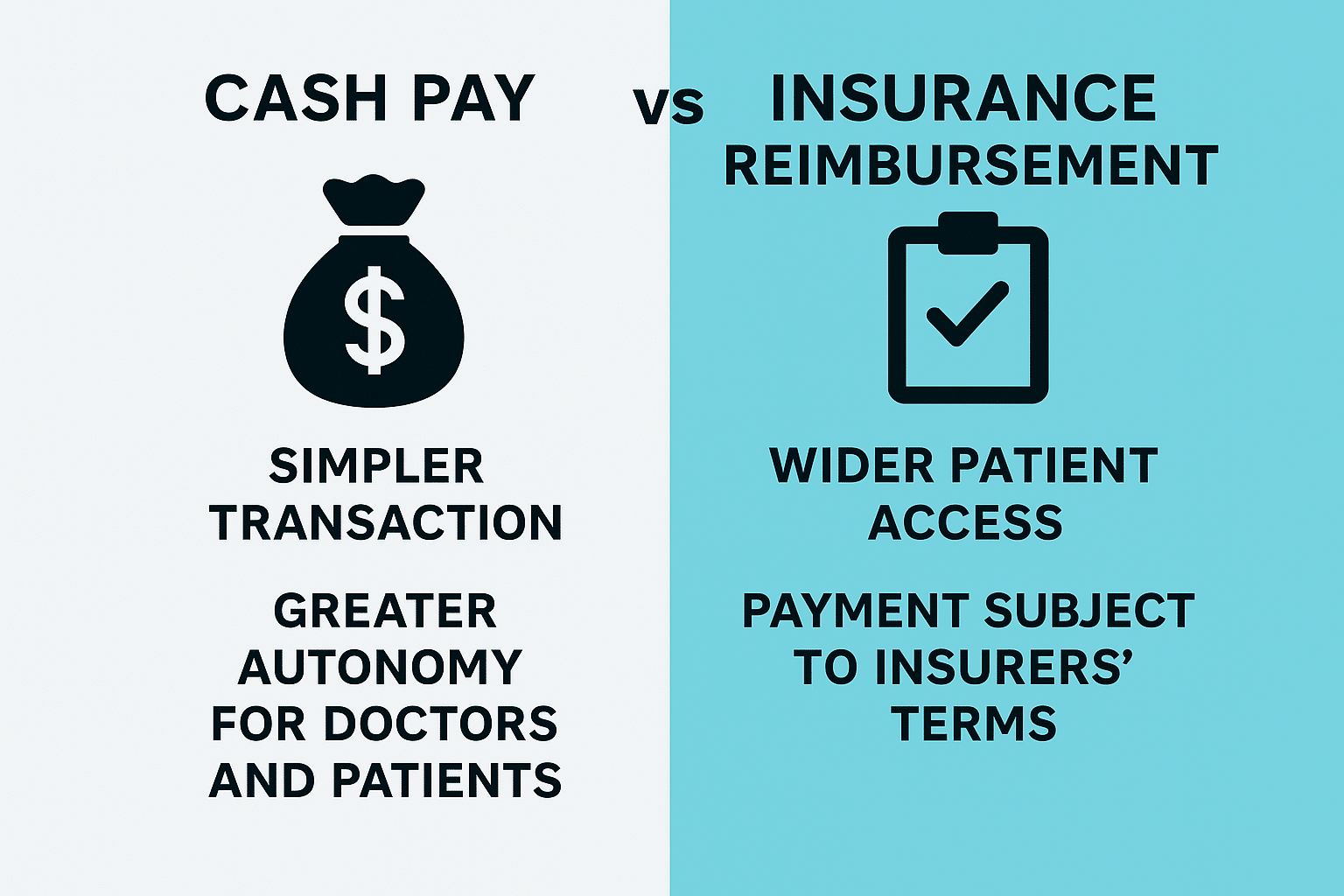

There’s a growing trend in private healthcare: cash pay models are gaining momentum. So that begs the question cash pay vs insurance reimbursement, what is the best revenue model for your practice.

And it’s not hard to see why cash pay is the growing trend.

Providers are frustrated with insurance companies telling them how to treat patients, when, and what they’ll be reimbursed for. Meanwhile, patients are fed up with high deductibles, surprise bills, and complex coverage rules. Many are asking:

“Why can’t healthcare be simple—just like everything else?”

That’s the appeal of cash pay healthcare.

It simplifies the transaction. It puts decision-making back in the hands of doctors and patients.

Of course, it’s not quite that simple.

Where Cash Pay Makes Sense

For some private practices—especially those offering boutique or specialized care—a cash pay model can absolutely thrive. Whether through:

-

Subscription-based care

-

Flat-rate visits

-

Bundled service packages

-

Interest-free payment plans

The key is designing a structure that works for your patients, your specialty, and your business model.

Don’t Count Out Insurance Reimbursement

There’s no denying it—insurance-based models still give you access to a broader patient base. That reach is critical in most markets.

But here’s the catch:

You’re playing by their rules.

Insurance companies determine what’s covered, what’s appropriate, and what they’ll pay—regardless of your time, expertise, or the true cost of care.

It’s frustrating. But for most traditional practices, insurance reimbursement is still a necessary part of doing business.

Should You Consider a Hybrid Model?

Here’s where many providers miss out:

You don’t have to choose just one.

While compliance with your insurance contracts is essential, you can still offer cash pay services for:

-

Non-covered treatments

-

Non-insured patients

-

Patients who prefer up-front pricing

Start simple:

1. Identify your top 10–20 procedures.

2. Create clear bundled cash pay prices.

3. Present those prices with full transparency.

For example:

A patient presents with heel pain. You may:

-

Do a new patient consult

-

Take digital X-rays

-

Provide a brace

-

Recommend therapy tools

Bundle this as one clear, cash-pay option. No surprises. Just transparency.

Why Patients Like Cash Pay Options

Not every patient wants to deal with insurance—especially when they know they won’t hit their deductible.

Offering cash pay benefits both sides:

-

Faster payment

-

Lower administrative costs

-

Greater patient satisfaction

-

More financial control for the patient

Even a small discount can make it feel like a better deal, even if the final amount is similar.

Final Thoughts: Flexibility Is the Future

Whether you’re all-in on insurance or experimenting with cash pay services, the key is balance.

In the debate of cash pay vs insurance reimbursement, there’s no one-size-fits-all answer—but ignoring one model entirely is a missed opportunity.

Patients want consumer-driven healthcare with:

-

Clear pricing

-

Fewer billing surprises

-

Simpler care options

Providing that doesn’t just improve the patient experience—it improves your revenue model.

Need Help Navigating Cash Pay vs Insurance Reimbursement?

At Aspire Health Management, we help practices strategically balance cash pay and insurance reimbursement models.

We offer:

-

Medical Billing

-

Fractional CFO Services

-

Operational & Financial Strategy

Let’s build a smarter, more profitable practice—without compromising patient care. Contact us today for a free business audit and see where you can increase cashflow and reduce expenses.